Record Number of Companies Report New Reshoring in 2018; Strongest in Casting Intense Industries

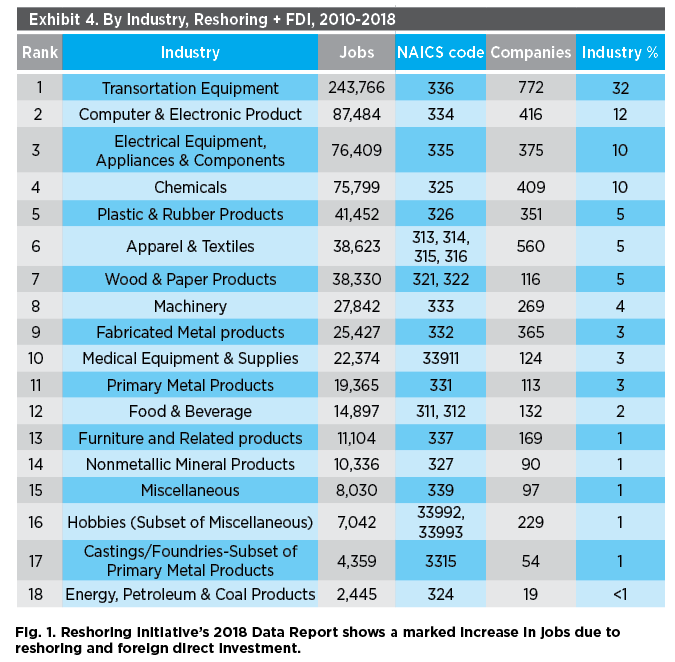

In 2018, the number of US companies reporting new reshoring and foreign companies reporting FDI (foreign direct investment) was at the highest level in recorded history, and the highest rates of reshoring have been in casting intense industries such as transportation equipment, appliances and machinery.

Reshoring and FDI in 2018 was up 38% from 2017 to 1,379 companies. Job announcements remained strong, adding more than 145,000 jobs and reaching the second highest annual rate on record, second only to the over 170,000 announcements reported for 2017. We include actions by OEMs and suppliers in the statistics. When a company shifts from an offshore to a domestic casting source, the domestic foundry has also reshored.

An additional 36,000 revisions to the years 2010-2017, increased the total number of manufacturing jobs brought to the U.S. from offshore to over 757,000 since the manufacturing employment low of 2010. The cumulative announcement equals 31% of the total increase in U.S. manufacturing jobs since the employment low of February 2010 and 3.3% of the total Dec. 31, 2018, manufacturing employment of 12.8 million.

Since 2010, rising Chinese wages, low U.S. energy costs, intellectual property concerns and advancements in technology and automation have been influencing more companies to consider U.S. manufacturing. The acceleration of the last few years is largely based on greater U.S. competitiveness due to corporate tax and regulatory cuts, and increased recognition of the total cost of offshoring.

Trade Deficit

The future of U.S. manufacturing depends substantially on our success in reducing, rather than further increasing, our goods trade deficit. That deficit, after adjustment for price differences, equals about 40% of actual U.S. manufacturing output, or about 5 million manufacturing jobs at current U.S. productivity levels. No other opportunities come close to offering such an impact on U.S. manufacturing and the U.S. economy.

Factors Driving the Trend

About 60% of companies decided to offshore based on comparing wage rates, Ex-Works prices, or landed costs. Much of the strength of the reshoring trend has been due to companies becoming familiar with a broad range of factors (costs and risks) they had previously ignored. Understanding the reasons other companies have given for reshoring helps companies determine whether those reasons apply to them also and helps suppliers make the case for domestic sourcing. A broad range of costs and risks can be quantified using the free online Total Cost of Ownership Estimator.

Freight cost has always been high on the list, but we expect it and green considerations to become more relevant as the new emission reduction initiative by the International Maritime Organization (IMO) is implemented in 2019-2020. This IMO effort to reduce the shipping industry’s greenhouse gas emissions by 50% from 2008 levels by 2050, will enforce a ban on ships using fuel that has a sulfur content of 0.5% or higher. This mandate is estimated to cost the shipping industry an additional $60 billion in annual fuel bills, about a 25% increase. Much higher freight costs will especially help motivate the reshoring of dense, relatively low-price per pound, and low-labor content products such as castings.

Accelerating Reshoring

The Reshoring Initiative’s tools and data can help companies make better sourcing decisions and sell against imports. On the website www.ReshoreNow.org you will find:

- Total Cost of Ownership Estimator for sourcing and selling (www.reshorenow.org/tco-estimator).

- Import Substitution Program (ISP) (www.reshorenow.org/isp).

- Supply Chain Gaps (part of ISP).

- Advanced Library Search (www.reshorenow.org/library-search).

- National Metalworking Reshoring Award. Castings are eligible. Customer company or foundry can apply.

- e-Newsletter (www.reshorenow.org/enewsletter).

Click here to see this story as it appears in the July/August 2019 issue of MCDP.