Handling Surcharges

Math and accurate data are keys to getting buyers and casting suppliers on the same page.

To surcharge or not to surcharge? This is no longer the question casting buyers and sellers are asking.

In today’s environment, the correct question to ask is, “How do we manage foundry surcharges most optimally?” With the instability of the scrap steel and pig iron market—although steel and pig iron can be somewhat predictable with a little research and following the macro-economic factors within the market —the overall instability of the market has led many foundries in the U.S. to establish a base price for existing business and for new projects they are quoting. The surcharges are then generally applied on a “per pound” basis that fluctuate monthly. When the market prices go up or down, this reflects the total selling cost either in the total selling cost or as a second line item reflecting the surcharge portion of the total selling cost broken out on the invoices. Each invoice reflects the total cost of the part being sold.

Some metalcasters are applying energy into the calculation of the surcharges. For this, as well as the scrap steel and pig iron, both parties will need to agree on a formula and what index to follow when making these adjustments.

For simplicity, examples given here will only consist of ferrous castings; however, the same formula of management can be applied to the nonferrous industry as well. The only change would be material content considered as a recipe.

What are some of the components of the surcharges we are discussing? The two major components are scrap steel (recycled steel) and pig iron. This generally makes up 90-95% of the recipe a foundry uses to pour castings. The rest of the components are various alloying elements such as carbon, silicon, nickel, and manganese. How much of each raw material content used will vary on the grade of the iron casting and the formula/recipe each foundry is using.

Let’s dive into some of the methods companies use to manage this complicated process and minimize administrative cost for managing price lists, avoid purchase order price vs. invoice discrepancies, and ease frustration for both firms’ accounting departments.

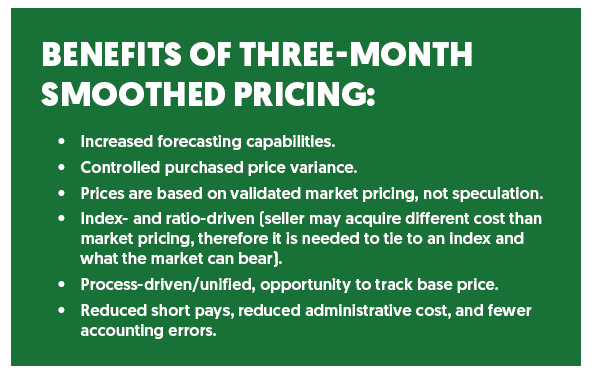

First, we need a reliable, trusted and accurate representation of a data source. Most buyers and sellers choose to use Scrap Price Bulletin, a source for steel and iron scrap prices for scrap brokers, generators, distributors, and manufacturers with a weekly assessment for scrap prices in 18 major markets across North America. It is crucial to have an index to tie the adjustment process as frequently as the agreement states between transactions. Typically, both the seller and the buyer would like to review pricing on a quarterly basis, and there are some benefits: less frequent pricing adjustment, less administrative efforts, and lower cost to both parties accounting.

This also helps with minimizing invoice discrepancies based on timing when the adjustment is applied within the buyer’s operating system, which ultimately causes the price to be adjusted on the purchasing orders.

Once the grade or grades of scrap steel and pig iron have been selected, and how energy will be accounted for has been agreed upon, an index needs to be selected. Finally, the frequency of reviewing the surcharge and how invoices will be submitted also needs to be discussed and agreed upon. Both parties’ operating systems may or may not allow for the surcharges to be added within the selling cost or to be added as a second line item on the invoice. This needs to be discussed and agreed to avoid complications and accounting errors once established.

In the following example, the Scrap Price Bulletin in the Cleveland market is used, and assume the metalcaster is using “No. 1 busheling” as a major source for scrap steel, and the price for a gross ton is $345 for illustration purposes. No. 1 busheling is a prime grade of industrial scrap metal that’s typically generated off the factory floors of manufacturers and other metal processing facilities. This grade has also been used as a key performance indicator for the U.S. automotive and manufacturing industries. No. 1 busheling is defined as clean steel scrap, not exceeding 12 inches in any dimensions, including new factory busheling. As specified by the Institute of Scrap Recycling Industries, No. 1 busheling may not include old auto body and fender stock.

Assuming a surcharge adjustment is made knowing the metalcaster is using No. 1 busheling at $345 per gross ton plus Brazilian pig iron at $500 per gross ton, we are not including any other calculations for energy and alloys. Looking at a quarterly adjustment process, this is how the adjustment process would look.

For a Jan. 1 effective date, the calculation takes an average of the actual price per gross ton (2,240 lbs.) of No. 1 busheling for October, November, and December, which is $345 for October, $355 for November, and $350 for December, which averages to $350 per gross ton ($0.15625 per pound).

The same calculation based on the three-month average is applied to pig iron, in this case assuming the average cost is $0.2232 per pound. If the metalcaster’s melt ratio is 75% of No. 1 busheling scrap steel and 20% of pig iron, then the calculation takes 75% of the $0.15625 per pound cost and 20% of the $0.2232 pig iron per pound cost, which comes to $0.1172 per pound for scrap steel and $0.04464 per pound for pig iron.

Assuming the base metal price agreed on is $0.122 per pound, this cost would be subtracted from the total.

($0.1172 scrap steel per pound + $0.04464 per pound for pig iron) = $0.1618 - $0.122 (Base) = $0.03984

So, $0.03984 would be the difference, or the new surcharge rate.

The final step is to take the original surcharge rate per pound price, which in this case was $0.05, and subtract the new surcharge rate of $0.03984. The difference is calculated by multiplying the new rate of $0.03984 with the weight of the component.

With the original surcharge rate of $0.05 per pound, the calculated surcharge on an 80-lb. part would be $4.

$0.05 X 80 = $4, where $4 is the new surcharge cost

In this example, the original base price of the casting was $60 + $4 for surcharge for a total of $64 total selling price. With the new surcharge rate of $0.03984 per pound, the calculated surcharge cost on the 80-lb. part comes to $3,1872

($0.03984 X 80) = $3.1872

The new total selling price would then be $60 + $3.1872 = $63.1872, a difference of $0.8128.

Whether the buyer or the seller requests this cost to be broken down on invoices depends on the operating system’s capabilities, accounting rules, and the agreement of the parties. The base always remains the same and the only price change is from the surcharge, which is a simple calculation of the amount of material applied by the ratio.

This all sounds complicated; however, once in an agreement, it is just math. So, it can be applied within a process where the seller notifies the buyer on the schedule shown on Table 1, then the seller can cross-reference the calculations and send the price list back confirming the calculation accuracy and weight of the casting, applying the adjustment for each part purchased. Once both parties confirmed the calculations are correct, the Price Change Authorization can be submitted either via Electronic Data Interchange or manually for the Jan. 1 effective date. This process can be followed for each quarter afterwards.

All buyers and sellers are encouraged to monitor and track appropriate indexes on a monthly basis for energy, alloys, scrap steel, and pig iron or the appropriate commodities in order to be able to calculate the actual cost of melt for making parts.

Click here to see this story as it appears in the November/December 2019 issue of Casting Source.